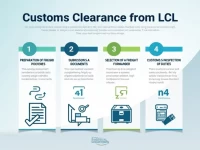

Detailed Process of Customs Clearance for LCL Shipping

This article focuses on the customs clearance procedures involved in LCL (Less than Container Load) shipping, including the preparation of cargo lists, document submission, duty payment, and customs inspections. Given that LCL shipments involve multiple shippers, the customs clearance process can be complex. It is advisable for shippers to seek assistance from experienced agents to ensure compliance and smooth release. Understanding these steps is crucial for the success of international trade.